Operation of the Petty Cash Book

Determine the operation of the petty cash Book

Petty Cash Book:

Petty cash book is a kind of cash book which records large number of small payments such as conveyance, cartage, postage, telegrams and other expenses under the imprest system. These expenses are repetitive in nature. The procedure becomes cumbersome if all small and repetitive payments are handled by the main cashier and are recorded in the main cash book.

The cash book may become very bulky and the cashier may be overburdened.

Applying the rule of ‘management by exception’ the main cashier should

not be disturbed for small and petty items.

Applying the rule of ‘management by exception’ the main cashier should

not be disturbed for small and petty items.

Big

organizations normally appoint one or more cashier known as ‘Petty

Cashier’ and assign the handling of petty expenses. Sometimes the work

of handling small and petty expenses is assigned to an existing employee

who in addition to his normal duties maintains a separate cash book to

record these petty and small cash transactions. For this purpose petty

cash book is to be maintained by such employee. The petty cashier so

appointed for recording the small and petty expenses works on the

imprest system.

organizations normally appoint one or more cashier known as ‘Petty

Cashier’ and assign the handling of petty expenses. Sometimes the work

of handling small and petty expenses is assigned to an existing employee

who in addition to his normal duties maintains a separate cash book to

record these petty and small cash transactions. For this purpose petty

cash book is to be maintained by such employee. The petty cashier so

appointed for recording the small and petty expenses works on the

imprest system.

Difference between Cash Overage and Shortage

Distinguish between cash overage and shortage

Situation

in which the physical amount of cash on hand differs from the book

recorded amount of cash. When a business is involved with

over-the-counter cash receipts, occasional errors may occur in making

change. The cash shortage or overage is revealed when the physical cash

count at the end of the day does not agree with the cash register tape.

Assuming that the count is Sh.60000 and the cash register reading shows

Sh.62000, the cash shortage and overage account would be charged for

2000. It is shown in the income statement.

in which the physical amount of cash on hand differs from the book

recorded amount of cash. When a business is involved with

over-the-counter cash receipts, occasional errors may occur in making

change. The cash shortage or overage is revealed when the physical cash

count at the end of the day does not agree with the cash register tape.

Assuming that the count is Sh.60000 and the cash register reading shows

Sh.62000, the cash shortage and overage account would be charged for

2000. It is shown in the income statement.

Meaning and Implication of the Imprest System and Petty Cash Vouchers

Explain the meaning and application of the imprest system and petty cash vouchers

Imprest System:

Under

the impress system, a fixed amount say Rs. 5,000 is given to the petty

cashier for incurring small and petty expenses. This amount is called

imprest money. The petty cashier makes all the payments for which he is

authorized out of the imprest amount. After a specific period or as soon

as he exhausts the full imprest amount, whichever is earlier, he gets

reimbursement for the actual amount spent by him from the main cashier.

the impress system, a fixed amount say Rs. 5,000 is given to the petty

cashier for incurring small and petty expenses. This amount is called

imprest money. The petty cashier makes all the payments for which he is

authorized out of the imprest amount. After a specific period or as soon

as he exhausts the full imprest amount, whichever is earlier, he gets

reimbursement for the actual amount spent by him from the main cashier.

Thus

at the beginning of the next period he once again has the full imprest

amount. Keeping in view the quantum of amount involved and frequency of

transactions, reimbursement of amount is made on a weekly, fortnightly,

monthly basis. Sometimes the petty cash system is operated through the

main cash book and in that case petty cash book is not maintained

independently.

at the beginning of the next period he once again has the full imprest

amount. Keeping in view the quantum of amount involved and frequency of

transactions, reimbursement of amount is made on a weekly, fortnightly,

monthly basis. Sometimes the petty cash system is operated through the

main cash book and in that case petty cash book is not maintained

independently.

Advantages:

- Reduces the labour: Petty

cash book is based on the division of labour and works on imprest

system; hence, it reduces the work and labour of main cashier. - Controls irregular expenses: One

of the famous principles of management is ‘control by exception’ which

means that if one person tries to control everything, he may end up

controlling nothing. Based on this principle, a petty cashier is

appointed who can control the irregular expenses. In the absence of

petty cashier, it is very difficult to watch and control the necessities

of incurring any expenses. - Main cash book does not become over bulky: Petty

cash book helps to keep the main cash book in a compact form because

numerous entries for small and petty items are recorded in the petty

cash book itself. - Quick payment possible: In

petty cash book, payments for petty items are recorded. Though they are

small, yet they are essential. Sometimes they are so urgent that they

cannot wait for approval of the higher authority. In that case quick

payment is required and this can be made by the petty cashier.

Sorting out Different Petty Expenditures and the Technique of Recording them in the Petty Cash Book and Journals

Sort out different petty expenditures and the technique of recording them in the petty cash book and journals

Types of Petty Cash Books:

There are the two methods of preparing petty cash book:

- Simple Petty Cash Book

- Analytical Petty Cash Book or Columnar Petty Cash Book

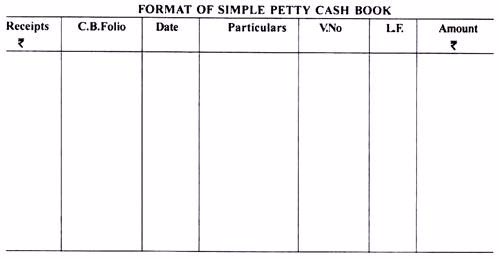

I. Simple Petty Cash Book:

In

simple petty cash book there is one column each for recording of

receipt of cash from the main cashier and for payment of petty expenses.

‘Date’ and ‘Particulars’ column is same for receipts and payments. In

the ‘C.B. Folio’ column, page number of cash book in which payment to

petty cashier is made is to be recorded.

simple petty cash book there is one column each for recording of

receipt of cash from the main cashier and for payment of petty expenses.

‘Date’ and ‘Particulars’ column is same for receipts and payments. In

the ‘C.B. Folio’ column, page number of cash book in which payment to

petty cashier is made is to be recorded.

In

the particular column heads of the items are to be mentioned. In ‘V

.No’ column, voucher number of the transactions are recorded. ‘L.F.’

column shows where the posting of these items have been made in

respective ledgers. ‘Amount’ column shows the money value of the

transactions.

the particular column heads of the items are to be mentioned. In ‘V

.No’ column, voucher number of the transactions are recorded. ‘L.F.’

column shows where the posting of these items have been made in

respective ledgers. ‘Amount’ column shows the money value of the

transactions.

The format of simple petty cash book is as under:

II. Analytical Petty Cash Book:

Analytical

Petty Cash Book or Columnar Petty Cash Book is different from the

simple petty cash book in the sense that in this type of petty cash

book, an analytical presentation of cash payment is made. All petty

payments are to be classified into different heads and different columns

are maintained.

Petty Cash Book or Columnar Petty Cash Book is different from the

simple petty cash book in the sense that in this type of petty cash

book, an analytical presentation of cash payment is made. All petty

payments are to be classified into different heads and different columns

are maintained.

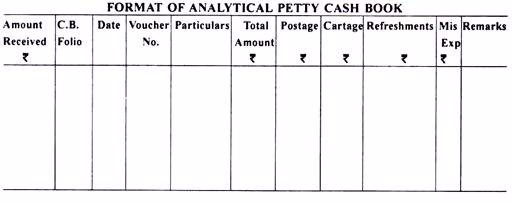

The format of the analytical petty cash book is as under:

Explanations to the Various Columns & Balancing the Analytical Petty Cash Book:

Receipts

are recorded in one amount column on the receipts (debit) side known as

‘Amount Received’ column. However, for recording receipts and payments

the column for date, voucher number and particulars are common. For

recording petty expenses, petty cash book has one column on the payment

(credit) side which is known as ‘Total Amount’ column.

are recorded in one amount column on the receipts (debit) side known as

‘Amount Received’ column. However, for recording receipts and payments

the column for date, voucher number and particulars are common. For

recording petty expenses, petty cash book has one column on the payment

(credit) side which is known as ‘Total Amount’ column.

In

this column total of various expenses paid by same voucher and on the

same day are recorded at one place. The total amount column is followed

by number of columns for recording the heads of items which are most

common in the business enterprise.

this column total of various expenses paid by same voucher and on the

same day are recorded at one place. The total amount column is followed

by number of columns for recording the heads of items which are most

common in the business enterprise.

After

allotting the columns to most common heads, one column is allotted for

recording miscellaneous items which are known as “Miscellaneous’ column.

Payments for which a separate column does not exist are recorded in

this column.

allotting the columns to most common heads, one column is allotted for

recording miscellaneous items which are known as “Miscellaneous’ column.

Payments for which a separate column does not exist are recorded in

this column.

The

last column is allotted for ‘Remarks’. The nature of payments is

recorded in this column. All amount columns are totaled at the end of

the period. The total amount spent and the amount reimbursed shall be

shown in the total amount column.

last column is allotted for ‘Remarks’. The nature of payments is

recorded in this column. All amount columns are totaled at the end of

the period. The total amount spent and the amount reimbursed shall be

shown in the total amount column.

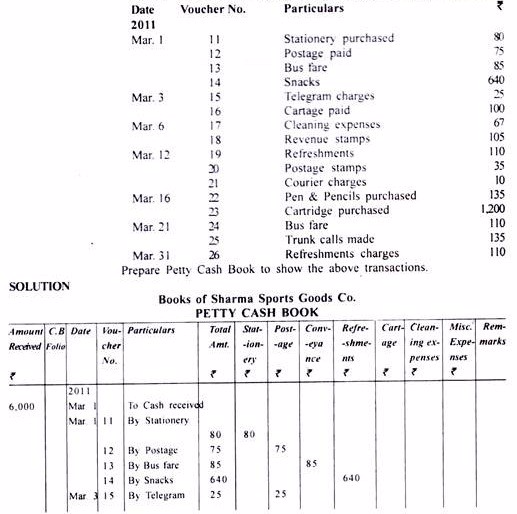

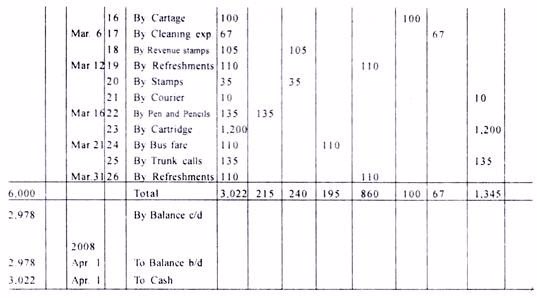

Illustration 3: (Petty Cash Book)

Sharma

Sports Goods Co. follows the imprest system of petty cash under which,

Rs 6,000 was handed over to the petty cashier as on 1st March 2011.The expenses during the month were as follows:

Sports Goods Co. follows the imprest system of petty cash under which,

Rs 6,000 was handed over to the petty cashier as on 1st March 2011.The expenses during the month were as follows:

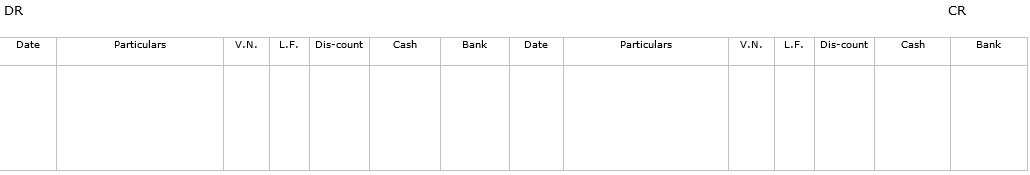

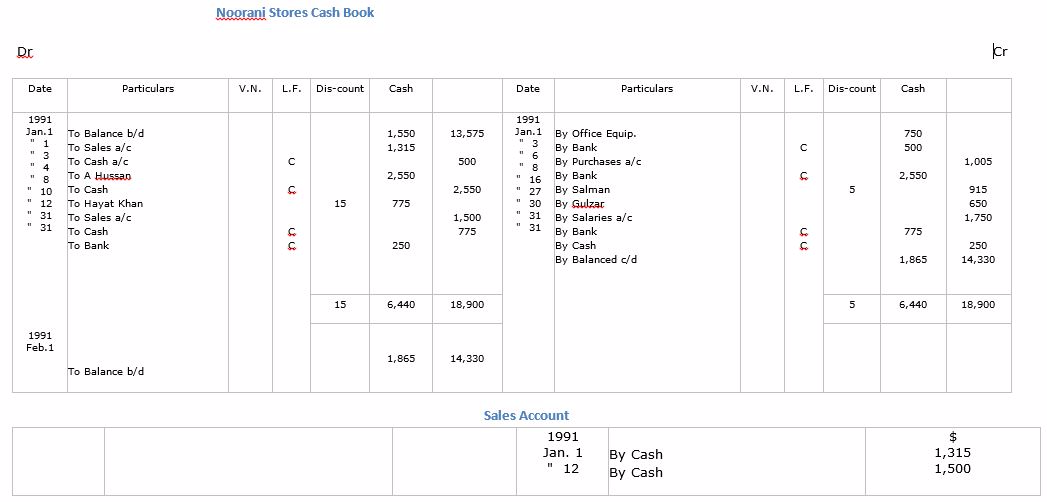

Format of the Three Column Cash Book:

Example of Three Column Cash Book:

| 1991 | |

| Jan.1 | Purchased office typewriter for cash $750; cash sales $315 |

| “ | Deposited cash $500 |

| ” 4 | Received from A. Hussan a cheque for $2,550 in part payment of his account |

| ” 6 | Paid by cheque for merchandise purchased worth $1,005 |

| ” 8 | Deposited into bank the cheque received from A. Hussan. |

| ” 10 | Received from Hayat Khan a cheque for $775 in full settlement of his account and allowed him discount $15. |

| ” 12 | Sold merchandise to Divan Bros. for $1,500 who paid by cheque which was deposited in the bank. |

| ” 16 | Paid Salman $915 by cheque, discount received $5 |

| ” 27 | Paid to Gulzar Ahmad by cheque $650 |

| ” 30 | Paid salaries by cheque $1,750 |

| ” 31 | Deposited into bank the cheque of Hayat Khan. |

| ” 31 | Drew from bank for office use $250. |

You are required to enter the above transactions in three column cash book and balance it.

Solution:

What a information of un-ambiguity and preserveness of precious experience concerning unpredicted feelings.

Thank you for sharing your thoughts. I really appreciate your efforts and I am waiting for your further post thanks

once again.

Hi there, I do think your blog may be having web browser compatibility problems.

When I look at your web site in Safari, it looks fine however,

if opening in I.E., it has some overlapping issues.

I simply wanted to provide you with a quick heads up! Aside from that, great blog!