Statements Showing Profit or Loss From Incomplete Records

Draw up statements to show profit or loss from incomplete records Some times, businesses, especially small businesses do not maintain a full set of double entry records. Consequently, no trial balance will be produced and a complete set of final accounts cannot be prepared without further analysis of the records that do exist.

Where only records available are the assets and liabilities at the beginning of the year and at the end of the year, it is not possible to prepare a Trading and Profit and Loss account. The assets and liabilities are usually listed in a Statement of Affairs (Similar to a Balance Sheet).

This would have been called a Balance Sheet if it had been drawn up from

a set of double entry records. Like a Balance Sheet, a Statement of

Affairs can be prepared horizontally or vertically.

This would have been called a Balance Sheet if it had been drawn up from

a set of double entry records. Like a Balance Sheet, a Statement of

Affairs can be prepared horizontally or vertically.

The

only way the profit for the year can be found is by comparing the

capital shown in the opening Statement of Affairs with the capital shown

in the closing Statement of Affairs.The basic formula is:

only way the profit for the year can be found is by comparing the

capital shown in the opening Statement of Affairs with the capital shown

in the closing Statement of Affairs.The basic formula is:

Profit Loss = Closing Capital – Opening Capital (Positive figure means Profit and Negative figure means Loss)

It

may be that the owner has made drawings during the year, which will

account for some of the difference in the capital figures. Similarly the

owner might have brought in additional capital during the year, which

will also account for some of the difference in the capital figures. In

this case the formula must again be modified:-

may be that the owner has made drawings during the year, which will

account for some of the difference in the capital figures. Similarly the

owner might have brought in additional capital during the year, which

will also account for some of the difference in the capital figures. In

this case the formula must again be modified:-

Profit

or Loss = Closing Capital + Drawings during the year – Additional

Capital during the year – Opening Capital (Positive figure means Profit

and Negative figure means Loss)

or Loss = Closing Capital + Drawings during the year – Additional

Capital during the year – Opening Capital (Positive figure means Profit

and Negative figure means Loss)

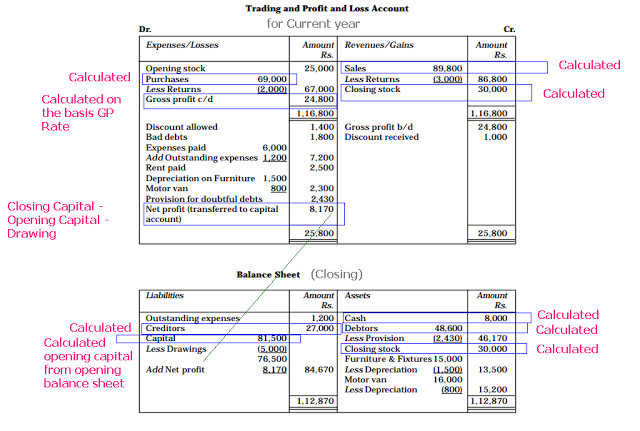

Calculation of Profit or Loss by converting the Incomplete Records into Double entry Records,

In

this case, in order to calculate the profit or loss of the business

during the year, the Trading and Profit and Loss accounts are prepared.

For preparing the Trading and Profit and Loss accounts, all necessary

information is not available in the books. So first the missing items

have to be calculated which are necessary for the preparation of Trading

and Profit and Loss accounts.

this case, in order to calculate the profit or loss of the business

during the year, the Trading and Profit and Loss accounts are prepared.

For preparing the Trading and Profit and Loss accounts, all necessary

information is not available in the books. So first the missing items

have to be calculated which are necessary for the preparation of Trading

and Profit and Loss accounts.

Example 1

Trading, Profit and Loss Account

Prepare trading, profit and loss account

Example 2

From the following balances extracted from the books of X & Co.,prepare a trading and profit and loss accounton 31st December, 1991.

| $ | $ | ||

| Stock on 1st January | 11,000 | Returns outwards | 500 |

| Bills receivables | 4,500 | Trade expenses | 200 |

| Purchases | 39,000 | Office fixtures | 1,000 |

| Wages | 2,800 | Cash in hand | 500 |

| Insurance | 700 | Cash at bank | 4,750 |

| Sundry debtors | 30,000 | Tent and taxes | 1,100 |

| Carriage inwards | 800 | Carriage outwards | 1,450 |

| Commission (Dr.) | 800 | Sales | 60,000 |

| Interest on capital | 700 | Bills payable | 3,000 |

| Stationary | 450 | Creditors | 19,650 |

| Returns inwards | 1,300 | Capital | 17,900 |

The stock on 21st December, 1991 was valued at $25,000.

Solution

X & Co.Trading and Profit and Loss Account For the year ended 31st December, 1991

| To Opening stock | 11,000 | | | By Sales | 60,000 | ||

| To Purchases | 39,000 | | | Less returns i/w | 1,300 | ||

| Less returns o/w | 500 | | | 58,700 | |||

| 38,500 | | | By Closing stock | 25,000 | |||

| To Carriage inwards | 800 | | | ||||

| To Wages | 2,800 | | | ||||

| To Gross profit c/d | 30,600 | | | ||||

| | | ||||||

| 83,700 | | | 83,700 | ||||

| | | ||||||

| To Stationary | 450 | | | By Gross profit b/d | 30,600 | ||

| To Rent and rates | 1,100 | | | ||||

| To Carriage outwards | 1,450 | | | ||||

| To Insurance | 700 | | | ||||

| To Trade expenses | 200 | | | ||||

| To Commission | 800 | | | ||||

| To Interest on capital | 700 | | | ||||

| To Net profit transferred to capital a/c | 25,200 | | | ||||

| | | ||||||

| | | ||||||

| 30,600 | | | 30,600 | ||||

Preparation of Balance Sheet

Prepare balance sheet

Example 3

From the following balances extracted from the books of X & Co.,prepare a balance sheeton 31st December, 1991.

| $ | $ | ||

| Stock on 1st January | 11,000 | Returns outwards | 500 |

| Bills receivables | 4,500 | Trade expenses | 200 |

| Purchases | 39,000 | Office fixtures | 1,000 |

| Wages | 2,800 | Cash in hand | 500 |

| Insurance | 700 | Cash at bank | 4,750 |

| Sundry debtors | 30,000 | Tent and taxes | 1,100 |

| Carriage inwards | 800 | Carriage outwards | 1,450 |

| Commission (Dr.) | 800 | Sales | 60,000 |

| Interest on capital | 700 | Bills payable | 3,000 |

| Stationary | 450 | Creditors | 19,650 |

| Returns inwards | 1,300 | Capital | 17,900 |

The stock on 21st December, 1991 was valued at $25,000.

Solution

X & Co. Balance Sheet as at 31st December, 1991

| Liabilities | $ | | | Assets | $ | |

| Creditors | 19,650 | | | Cash in hand | 500 | |

| Bills payable | 3,000 | | | Cash at bank | 4,750 | |

| Capital | 17,900 | | | Sundry debtors | 30,000 | |

| Add Net profit | 25,200 | | | Bill receivable | 4,500 | |

| 43,100 | | | Stock | 25,000 | ||

| | | Office equipment | 1,000 | |||

| | | |||||

| 65,750 | | | 65,750 | |||

| | | |||||

Calculating Amount of Cash Stolen

Calculate amount of cash stolen

The

loss on theft of cash and any other assets may be simply be expensed to

the income statement net of any insurance claim received or receivable.

Following accounting entries would therefore be required:

loss on theft of cash and any other assets may be simply be expensed to

the income statement net of any insurance claim received or receivable.

Following accounting entries would therefore be required:

| Debit | Loss on asset theft (balancing amount) |

| Debit | Accumulated Depreciation |

| Credit | Asset (carrying amount) |

Calculating the Value of Stock at Cost which had been Stolen

Calculate the value of stock at cost which had been stolen

Activity 1

Calculate the value of stock at cost which had been stolen

An impressive share! I have just forwarded this onto a co-worker who had been conducting a little homework on this.

And he in fact bought me dinner due to the fact that I found it for

him… lol. So allow me to reword this…. Thank YOU for the meal!!

But yeah, thanks for spending time to discuss this subject

here on your web page.

We absolutely love your blog and find most of your post’s to be exactly

I’m looking for. Does one offer guest writers to write

content to suit your needs? I wouldn’t mind

writing a post or elaborating on a lot of the subjects you write with regards to here.

Again, awesome site!

Hi, I do believe this is an excellent site.

I stumbledupon it 😉 I am going to return yet

again since I book-marked it. Money and freedom is the greatest way

to change, may you be rich and continue to help others.

Hello there, There’s no doubt that your site could be having

browser compatibility problems. Whenever I

take a look at your web site in Safari, it looks

fine however, when opening in Internet Explorer, it’s

got some overlapping issues. I simply wanted to give you

a quick heads up! Other than that, excellent blog!

When some one searches for his necessary thing, therefore he/she wishes to be

available that in detail, thus that thing is maintained over here.

Can I just say what a relief to find someone who truly

knows what they’re talking about on the internet. You definitely realize how to bring an issue to light and make it important.

More people should read this and understand this side of your story.

I was surprised you aren’t more popular because you most

certainly have the gift.

I just like the valuable information you supply in your articles.

I’ll bookmark your weblog and take a look at again here regularly.

I am somewhat sure I’ll learn plenty of new stuff right here!

Best of luck for the next!

Hi friends, fastidious paragraph and pleasant arguments commented at this place, I am in fact enjoying by these.

Hi, I do believe this is a great web site. I stumbledupon it

😉 I’m going to come back once again since I bookmarked it.

Money and freedom is the best way to change, may you be rich and continue to guide others.