Jinsi ya kufungua Mastercard Tanzania,Learn jinsi ya kufungua Mastercard Tanzania with this simple 2025 guide. Requirements, steps, fees, providers, and how to apply easily.

Jinsi ya kufungua Mastercard Tanzania

If you shop online, pay for streaming services, travel, or receive international payments, having a Mastercard is almost essential. Mastercard is among the most trusted and widely accepted payment solutions worldwide—and the good news is that you can easily get it right here in Tanzania.

This complete guide explains jinsi ya kufungua Mastercard Tanzania in the simplest way possible. You will learn where to apply, requirements, types of cards, fees, activation steps, and important safety tips. Whether you are a beginner or switching from another card, this guide gives you everything you need.

What Is a Mastercard and Why Do You Need One in Tanzania?

A Mastercard is a payment card used for online shopping, ATM withdrawals, subscriptions, international payments, and in-store transactions. It is accepted in more than 200 countries, making it one of the most reliable financial tools.

Why Mastercard Is Important in Tanzania

- You can pay online on websites like Amazon, Alibaba, Jumia, Temu.

- It works for Netflix, Spotify, Apple services, and DSTV app.

- Freelancers can use it for PayPal and Payoneer withdrawals.

- It is safer than carrying cash.

- Supported by major banks and mobile money services.

Step 1 – Choose Where You Want to Get Your Mastercard

Mastercard cards in Tanzania are issued by banks and mobile money providers. You cannot get a card directly from Mastercard; instead, Mastercard partners with institutions that issue the cards.

Popular Mastercard Providers in Tanzania

- CRDB Bank – Debit, credit, and prepaid Mastercard.

- NMB Bank – Debit and credit Mastercard.

- Equity Bank Tanzania – Simple account opening and online support.

- Absa Bank Tanzania – Strong for international transactions.

- Vodacom M-Pesa Virtual Mastercard – Instant online card.

- Airtel Money Mastercard – Easy virtual card for digital use.

Step 2 – Understand the Types of Mastercard Available

1. Debit Mastercard

- Connected to your bank account.

- Spend only what you have.

- Works online and in ATMs.

2. Credit Mastercard

- Borrow and repay later.

- Requires income proof.

- Good for business and travel.

3. Prepaid Mastercard

- Load money before use.

- Great for budgeting.

- Easier approval.

4. Virtual Mastercard (M-Pesa / Airtel Money)

- No plastic card needed.

- Works online only.

- Instant and convenient.

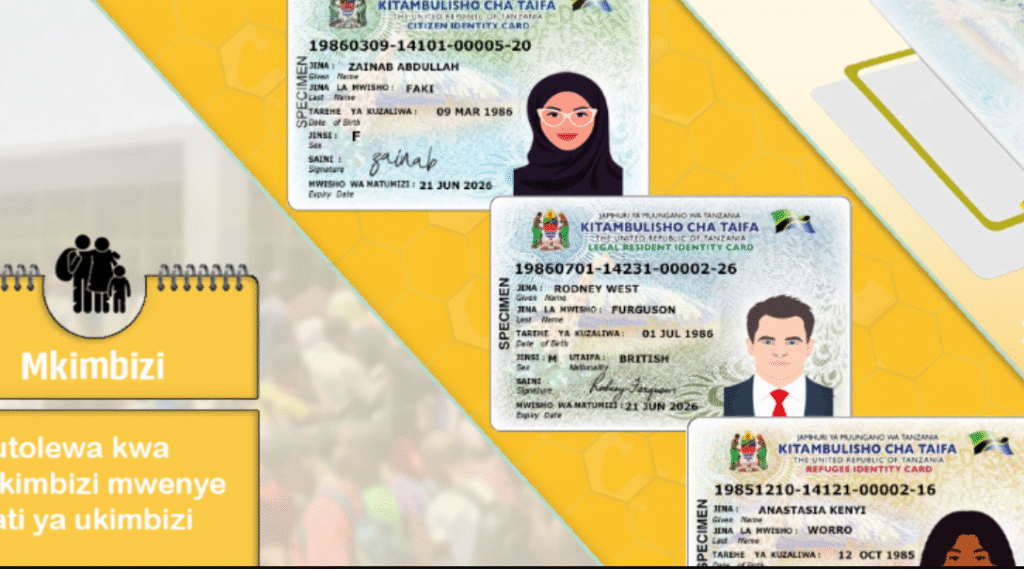

Step 3 – Prepare the Required Documents

- Valid NIDA ID or NIDA number printout.

- Passport photo (optional).

- TIN number for credit cards.

- Proof of income (credit card only).

- Minimum account deposit.

Read also : Nafasi za kazi Recacha Company Limited November 2025

Step 4 – Apply for Your Mastercard

Applying Through a Bank (CRDB, NMB, Absa, Equity)

- Visit the nearest branch.

- Open an account (if you don’t have one).

- Ask for a Mastercard application form.

- Fill in your personal details.

- Submit your documents.

- Pay issuance fee.

- Wait 3–7 working days.

Applying Through Mobile Money

M-Pesa Virtual Mastercard

- Dial *150*00#

- Select M-Pesa

- Go to Global

- Select Virtual Mastercard

- Activate

Airtel Money Virtual Mastercard

- Dial *150*60#

- Select Airtel Money

- Choose Mastercard

- Activate

Step 5 – Understand the Fees for Mastercard Tanzania

- Debit Mastercard: TZS 10,000–20,000 annually

- Prepaid Mastercard: TZS 5,000–15,000

- Credit Mastercard: Depends on card limit

- Virtual Mastercard: Free, with small usage charges

Step 6 – Activate Your Mastercard

Activation Methods

- ATM machine

- Bank mobile app

- USSD code

- Bank branch

Step 7 – Start Using Your Mastercard

Where You Can Use It

- Supermarkets (Shoppers, TSN, Shreeji)

- Petrol stations

- Restaurants and hotels

- Government online portals

- Netflix, Spotify, DSTV, Amazon

- Online shopping (Amazon, Jumia, Alibaba, Temu)

- ATM withdrawals worldwide

Benefits of Opening a Mastercard in Tanzania

1. Easy International Payments

Perfect for travellers, students, and freelancers.

2. Online Shopping Freedom

Buy from global stores without restrictions.

3. Strong Digital Security

Advanced fraud protection.

4. Worldwide ATM Access

Withdraw money anywhere in the world.

5. Budget Control

Manage your spending better.

6. Great for Freelancers

Useful for PayPal and Payoneer withdrawals.

Safety Tips When Using a Mastercard

- Never share your PIN.

- Avoid using public Wi-Fi for transactions.

- Enable SMS or app alerts.

- Block the card immediately if lost.

- Ignore suspicious links.

Frequently Asked Questions (FAQ)

1. Can I open a Mastercard without a bank account?

Yes, using M-Pesa or Airtel Money virtual cards.

2. How long does a physical card take?

3–7 working days.

3. Are virtual Mastercards safe?

Yes, they offer strong digital security.

4. Can students open a Mastercard?

Yes, with NIDA details.

5. Does Mastercard work with PayPal or Payoneer?

Yes, many Tanzanian Mastercards are supported.

Conclusion

Opening a Mastercard in Tanzania is simple and convenient. Whether you choose a bank card or a virtual mobile money option, the process is fast and beginner-friendly. This guide has shown you jinsi ya kufungua Mastercard Tanzania step by step, including requirements, application methods, fees, and safety tips. With your card ready, you can enjoy secure international payments, online shopping, and global financial access.